INDIAN MARKET

Date: July 4, 2022

As consumers break the shackles of pandemic after overcoming the fear of health and hygiene during the last 2 years, retail markets looks brighter with more demand and better sales. Products in home category have particularly experienced consistently good demand, making the moods of retailers, brands and manufacturers more upbeat. Overall, the retailers of furnishing fabrics, bed & bath, mattresses & pillows, rugs and most other home textiles have reported good sales in the last three quarters with some inconsistency.

For some retailers, it has been the best ever period in their store sales. “After very good sales from October to March this year, primary reason for slightly lower sales in April and May months is that there were school vacations and people got an opportunity to get out of their homes and head for proper holidays after two years! This demand will pick up again from July and we expect a very good Diwali season,” Sanat Patel, Director, Vishvesh Textiles from Chennai. “Business has been very good in last 7-8 months, except a few days in May, which clearly was on account of holidays. I think business is already picking up and we expect to do very well in the coming Diwali season,” says Jayesh Dedhia, Director, One Stop, a leading chain of 10 houseware stores in Mumbai.

Reports coming in from Mumbai, Delhi, Kolkata, Bengaluru, Hyderabad, Ahmedabad, Jaipur, Ludhiana, Pune and Indore sum up similar sentiments of good business. Many tier 2 and tier 3 cities and towns are reporting better sales as spending by semi-urban consumer on their homes too has gone up. 11th edition of HGH India scheduled for July 12-15, 2022 at India Expo Centre, Greater Noida will open several new opportunities for retailers, distributors, wholesalers and institutional buyers to get new supplies of innovative products from their existing as well as new suppliers.

Supply side has been a major challenge for most retailers. Rising cotton prices, rising fuel costs, disruption in international supplies of raw materials and finished goods due to the Ukraine war situation, increased container cost, disruption in China based supply chain have all led to inconsistent availability of goods on retail shelves and rapid increase in prices. Retailers across categories are grappling with these challenges to maintain their supply lines, so that they do not lose business and customers from their stores. Many retailers and distributors have also taken a conscious decision to reduce their dependence on imported products by developing India based supply chains. Vast improvement in quality and increasing design innovations by Indian brands and manufacturers are also helping in this process.

HGH India 2022 will be a good opportunity for the trade to explore several innovative products and stabilise their supplies in categories like furnishing fabrics, blinds, bed & bath, decorative made-ups, table & kitchen linen, rugs & carpets, wallpaper, wooden & synthetic floorings, decorative accessories, handicrafts, home furniture, outdoor lifestyle, houseware, kitchenware, cookware, glassware, tableware, plastic products, kids’ home products and a variety of gifts. Innovations from over 400 brands and manufacturers from 30 countries and all major production & export centres from all over India will be on display at HGH India 2022. With a forecasted annual demand growth of over 20% for most of the home category products for the next 3-5 years, Indian market is heading for good times.

Source: Business Standard

Date: September 13, 2021

Unless a disruption erupts again, rural India seemed poised to help a recovery in consumer demand

By: Mahesh Vyas ( MD & CEO, CMIE P Ltd)

The index of consumer sentiments generated by CMIE using its Consumer Pyramids House¬hold Survey scaled up smartly by 5.3 per cent in the week ended September 12, 2021. It had increased by 3.9 per cent in the preceding week. As a result, the cumulative increase in Septem¬ber so far has been over 9 per cent. Given that India is now at the beginning of the 2021 festive season, this spurt in consumer sentiments is encouraging.

The Ganesh festival, which began on September 10, would continue through September 20. The first week of October would flag off the nine-day Navratri festivities. Diwali celebrations begin early in November and the month would continue to see festivities till Guru Nanak Jayanti on November 19. This period also sees the harvest of the kharif crop.

Buoyant consumer sentiments are important for the festive season to translate into enthusiastic consumer spending. This is why the 9 per cent increase seen in consumer sentiments so far in September is particularly important. It is important that consumer sentiments are cultivated to motivate households that have the spending power to spend during this festive season. In this respect, the truce between farmers and the government in Karnal was important.

It has also helped kharif sowing to finally catch up, in spite of a truant monsoon, and exceed the normal area sown. The crop could suffer a fall in yield because of the behavior of the monsoon. But the progress of sowing improved towards the end of the season compared to its prospects seen in the first half of the monsoon months. And, the crop damages because of September rains could help strengthen prices that have dropped a bit compared to March-April.

Perhaps, it is the improving kharif crop and other related factors that are impacting rural India, which is driving the spurt in consumer sentiments. Data show that it is indeed rural India that is driving the increase in consumer sentiments in recent weeks. In the week ended September 12, while the overall index of consumer sentiments grew by 5.3 per cent, the index for rural India grew by 9 per cent. Similarly, in the preceding week that ended on September 5, while the overall index of consumer sentiments increased by 3.9 per cent, the index for rural India grew by 4.9 per cent.

This phenomenon of rural India driving the all-India consumer sentiment index in September is a continuation of the same in August when the index had increased by a modest 1.7 per cent. This August increase was entirely concentrated in rural India. The rural index of consumer sentiments increased by 4 per cent in the month, while the index for urban India declined by 2 per cent in the same month.

Monthly estimates of the index of consumer sentiments permit greater dissection because of the larger sample involved. We dig into this to identify the prime source of the recent spurt in consumer sentiments of India’s rural folks.

First, while the rural index of consumer sentiments grew by 4 per cent in August 2021, it was essentially one income group in rural India that drove this growth. This was the group that earned annually between Rs 200,000 and Rs 500,000.

This is also the largest income group in rural India. Consumer sentiments of this group of people shot up by 12.5 per cent in the month of August. This is a fairly large set of households. In fact, it accounts for almost half of rural India. There were an estimated 69 million households in this group out of an estimated 215 million in rural India. This is the fat middle-income group of rural India. If consumer sentiments of nearly one-third of rural India see a spurt on the eve of the festive season, then there are implications on the growth of consumer markets in rural India in the coming few months.

A dissection of the August sentiments by occupation of households also reveals a similar concentration of consumer sentiments in one specific group. This is the salaried classes in rural India. The consumer sentiments index of this group increased by 16.1 per cent in August. This again is higher than the 4 per cent growth in consumer sentiments seen in rural India as a whole. The salaried classes are not very big in rural India as they don’t count much even at an all-India level. In rural India, these are estimated at about 23 million households. Nearly half of these, 11 million earn, between Rs 200,000 and Rs 500,000. These, we deduce, are the most gung-ho about their sentiments.

Evidently, there is a fairly large non-salaried segment in rural India — over 50 million households that earn between Rs 200,000 and Rs 500,000. These are quite optimistic at the moment. Among these, the businessmen and farmers reported an over 5 per cent increase in consumer sentiments in August. However, daily wage earners in rural India saw no increase in consumer sentiments.

Consumer sentiments in urban India have been subdued. Cumulatively, in the first two weeks of September, while the rural index of consumer sentiments rose by 14.3 per cent, the index for urban India rose by only one per cent. In the week ended September 12, it fell one per cent. In August, it had fallen by 2 per cent.

Unless a disruption erupts again, rural India seems poised to help a recovery in consumer demand.

Source: Economics Times

Date: June 9, 2021

In the north, rising summer temperatures have seen demand rise for refrigerators and air-conditioners.

Synopsis

Brands, retailers and online marketplaces said there has been a 10-15% spurt in sales from the year earlier as lockdowns started easing in the west, north and east, apart from online purchase of non-essentials resuming. Companies said demand is particularly robust for laptops, smartphones, washing machines, microwave ovens, kitchen appliances and small items of furniture as consumers continued to work from home during the second Covid wave.

Consumer electronics and smartphones have got a boost in the past 10 days or so, as states began easing pandemic-led curbs — similar to the bump from pent-up demand last year when the lockdown was lifted.

Brands, retailers and online marketplaces said there has been a 10-15% spurt in sales from the year earlier as lockdowns started easing in the west, north and east, apart from online purchase of non-essentials resuming.Companies said demand is particularly robust for laptops, smartphones, washing machines, microwave ovens, kitchen appliances and small items of furniture as consumers continued to work from home during the second Covid wave. In the north, rising summer temperatures have seen demand rise for refrigerators and air-conditioners.

Apparel brands said stores are yet to return to normal since malls have just begun opening, but ecommerce business has revived. Puma India managing director Abhishek Ganguly said online sales are back on track while stores are just about opening up, with reduced trading hours.

‘Better Than Last Year’

Electronics and smartphone retailers and brands have recovered smartly, executives said. Markets resuming operations are reporting higher consumption and footfalls than last year, said Kamal Nandi, business head at Godrej Appliances and president of the Consumer Electronics and Appliances Manufacturers Association. “Around 60% of the markets are already open and we expect the rest will open up in the next 10 days,” he said.

Nilesh Gupta, director at electronics retailer Vijay Sales, said markets such as Gujarat — which opened up in May — Mumbai and Pune, where sales started last week, reported 10-15% growth from last year. “Initial pent-up demand after the second wave is actually better than last year. This is also due to online channels opening up at the same time,” he said.

Some Curbs Remain

Delhi opened up this week with some curbs still in pace, while Haryana, Rajasthan, Telangana, Andhra Pradesh and West Bengal shops opened regularly for a longer duration this month. However, some like Haryana, Karnataka, Tamil Nadu, West Bengal and Maharashtra had allowed unrestricted ecommerce earlier. Some states, however, are still continuing with night curfews or weekend lockdowns.

Sales in the south are still muted. Karnataka and Tamil Nadu are yet to allow retail stores to open. However, ecommerce has surged in those markets as well. Online accounts for 10% of business now, up from 2%, said Chandu Reddy, director of Sangeetha Mobiles, the south’s largest cellphone retailer.

Tata-owned electronics chain Croma is reporting pent-up demand for summer appliances and laptops, which continue to grow at a high rate. Demand is similar to last year after reopening, said Croma chief marketing officer Ritesh Ghosal.

Industry executives said brands are lining up smartphone and electronics launches this month after a gap of almost two months to further drive demand.

Realme expects June sales to rise 50% from the year earlier, with pent-up demand accounting for 30%, said Madhav Sheth, chief executive for India and Europe at the phone maker. The company also expects demand to be sustained by new products. “The market has been quite active after the second wave,” he said.

Demand should improve gradually as people will work from home for a longer period after the second wave as they upgrade or buy new appliances, including televisions, said Deepak Bansal, vice-president, corporate planning, LG India.

Ecommerce companies confirmed a similar sales boost. A Flipkart spokesperson said overall demand for microwave ovens has almost doubled in the past month, with consumers preferring home-cooked meals to ordering out. Demand is also strong for laptops and smartphones, especially those with larger screens and greater storage capabilities, he said.

Consumers continue to upgrade their living spaces by buying small furniture, items related to cooking and home essentials, as well as items associated with weddings, such as lehengas, saris, beauty products and other ethnic wear.

Sustaining Demand

Electronics chain Great Eastern Retail director Pulkit Baid said the real test for pent-up demand will be in July, since June will report good numbers as some markets such as Mumbai were closed for over 60 days.

Croma’s Ghosal also said it has to be seen whether demand is sustained like last year. “The lockdown was not as complete this year for key categories such as smartphones and audio products, unlike last year,” he said. “Customers requiring a smartphone or an earphone could call up a local shop (owner), who was able to take stock out of his store and fulfil.”

The industry fears that consumers will probably be more careful about spending after facing steep medical bills due to the second wave.

he company hasn’t decided whether its furnishing-retail foray will be through a standalone format or existing stores would be leveraged to sell new product lines.

ET Bureau, May 23, 2019, 07:36 IST – Hennes & Mauritz (H&M) is keen to enter India’s home decor and furnishing products industry, a move that will pitch the global fashion retailer against local firms Bombay Dyeing and Fabindia, and its Swedish peer Ikea.

An offshoot of the high-street fashion label, H&M Home sells products such as cushion covers, blankets, curtains and accessories. “We are looking at the home segment and it will be decoration products and not furniture. There are not many players in that category and the product range doesn’t change for years. In the organised sector, our strength will be the latest assortment,” said H&M’s India chief executive Janne Einola.

The company hasn’t decided whether its furnishing-retail foray will be through a standalone format or existing stores would be leveraged to sell new product lines. Globally, H&M Home is mostly present with 362 shop-in-shops and eight standalone stores, in about 50 countries. With annual sales of `1,109 crore in India, H&M, the world’s second-largest clothing firm, has surpassed all apparel brands except Zara in revenue after three years of India operations. The Stockholm-based retailer stocks fast-fashion items created in-house, and teams up with designers for one-time collections.

It keeps a large inventory of basic, everyday items sourced from manufacturers in India and Bangladesh. These items carry lower price tags than those sold by rivals. Foreign single-brand retailers need to meet 30% local sourcing norms to operate their own stores in the country. H&M said India is a large global supplier for home products and if these items are sold locally, the sourcing norms would be met.

That would give the company significant cost advantages. “A bulk of sourcing for home products globally is from India and we’ll benefit in terms of sourcing, given these will be made in India and sold here too,” added Einola. Rising demand for premium and high-margin home furnishing products has drawn organised players to a segment that is largely unorganized in the country.

Ikea opened its first India-based store in Hyderabad last year,while the JSW group launched its brand Forma in the furniture and furnishings segment a month ago.

By Sagar Malviya, Writankar Mukherjee, Ketan Thakkar, ET Bureau| Updated: Nov 22, 2017, 12.26 AM IST

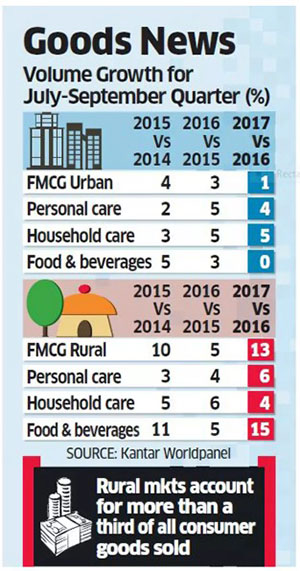

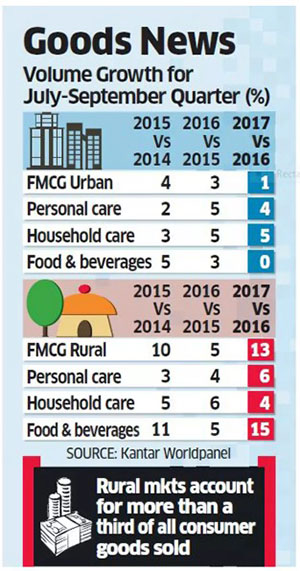

This is the second consecutive quarter of double-digit growth in the rural FMCG market, which helped to boost volumes in the overall fast-moving consumer goods sector by 7%.

MUMBAI / KOLKATA: Purchases of consumer products and automobiles in rural India picked up pace during July-September, outstripping the rate in cities, as a good monsoon lifted farm income. Rural sales of FMCG products by both value and volume — the number of products sold — increased 13% during the quarter from a year earlier, according to Kantar Worldpanel, the consumer insights arm of WPP, the world’s biggest advertising company. It was the fastest pace of growth in over three years.

In contrast, the urban market expanded 4% by value and 1% by volume during this period, the researcher said.

This is the second consecutive quarter of double-digit growth in the rural FMCG market, which helped to boost volumes in the overall fast-moving consumer goods sector by 7% compared with about 4% a year earlier. The rural market accounts for more than a third of all consumer goods sold. “In our case, rural growth has been very good.

GST itself is creating demand. There are other factors also — the economy is doing well and overall, we are back to normal,” said Adi Godrej, chairman of the Godrej Group, which sells appliances, food and grocery and personal and home care products.

“Companies have become proactive by increasing direct distribution in rural areas as the headroom for penetration is very high compared to urban, which is saturated,” said Abneesh Roy, senior V-P, institutional equities, Edelweiss Securities.

Edelweiss Securities’ Abneesh Roy said direct benefit transfer (DBT) for job guarantee schemes and crop procurement, which eliminates pilferage, has put more money in the hands of rural customers. Urban consumption growth was constrained primarily by foods, while home care expanded by 5% and personal care by 4%, continuing their normal growth trajectory, said K Ramakrishnan, country head at Kantar Worldpanel.

“The drop in growth of foods was driven by high-volume categories like atta and rice, which have shown a marginal decline,” Ramakrishnan said. Food accounts for almost 70% of the total volume sales, according to the researcher. Auto companies and manufacturers of refrigerators and washing machines said rural purchases have increased.

Maruti Suzuki, which sells one in every two cars in the country, said rural sales grew faster than in urban areas at 22% so far this financial year, the highest in recent years.

“Two consecutive good monsoons, strong minimum support price and increasing availability of finance has ensured higher off-take in the rural markets. Led by new models and expanding network, we expect to sustain the momentum,” said RS Kalsi, senior executive director of sales and marketing at Maruti.“Double-digit growth in rural areas has offered a cushion to slowing urban sales,” said Rakesh Srivastava, director of sales and marketing at Hyundai Motor India.

ELECTRIFICATION DRIVE HELPS

While white goods and television sales went up by 12-13% in July-September, their growth in rural India during this period was 16-17%, as per industry data. Executives said sales growth in rural India exceeded that in urban areas for the past three quarters. “Low penetration level and good monsoon boosting farmer income has been the main reason behind this higher growth in rural India,” said LG India director-sales Rajeev Jain.

Another reason the industry cited was the electrification drive in smaller markets, which is boosting demand. Over the past decade, sales of branded daily-need products in the nation of 1.3 billion people have increasingly relied on the vast rural hinterland, home to about 800 million people whose purchasing behaviour depends on farm output. Therefore, annual monsoon rains that help irrigate India’s crops play a vital role in shaping buying patterns in Asia’s thirdbiggest economy. Below-average monsoon rains over the past couple of years had been blamed for stagnant sales growth.

To counter the impact of the currency note ban announced in November last year, finance minister Arun Jaitley announced incentives built around farm infrastructure and credit for rural and lowincome consumers. “We are now witnessing a revival in demand and consumption, led by the hinterland,” said Lalit Malik, chief financial officer at Dabur India, the maker of shampoos, hair oils, fruit juices and health supplements. “Riding on the back of a good monsoon last year, coupled with a slew of fiscal reforms and higher spending on infrastructure by the government, the rural economy is already showing signs of revival and has been growing ahead of the urban markets.”

SENTIMENT IMPROVING

Market sentiment is improving and stabilising after the introduction of GST, which consolidates multiple central and state taxes into one. “We expect the demand scenario to move up, in both the rural and urban markets,” Malik said. According to some companies, several unorganised makers of unbranded consumer products such as detergents, oil and soaps sold in the rural areas were slow to register with the GST network or failed to comply with the new tax structure, helping bigger firms gain market share. Changes in pricing after GST also helped rural growth as rates fell for some products.

“We believe that GST can be converted into a competitive advantage since we compete with a lot of unorganised players that are affected due to the new tax regime,” said Saugata Gupta, MD at Marico. “The company expects rural to contribute nearly 40% of sales in the next few years.” In the run-up to the introduction of GST, several consumer companies cleared inventory across trade channels, especially in the urban markets, amid uncertainty over pricing of goods produced before the start of the new tax regime. A few months ago, most companies said the pace of re-stocking was slower in the rural markets as wholesalers adapted to the transition. They expected the situation to stabilise by July-end.

Hindustan Unilever, which posted a 10% rise in sales in the second quarter of the financial year, said that it was difficult to break up the growth on the basis of demand and inventory change. “For the market to move up significantly, rural growth will have to move up because that is where the headroom to grow is the maximum,” HUL MD Sanjiv Mehta said last month.

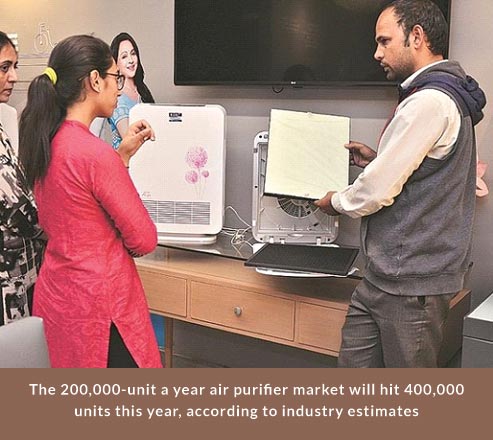

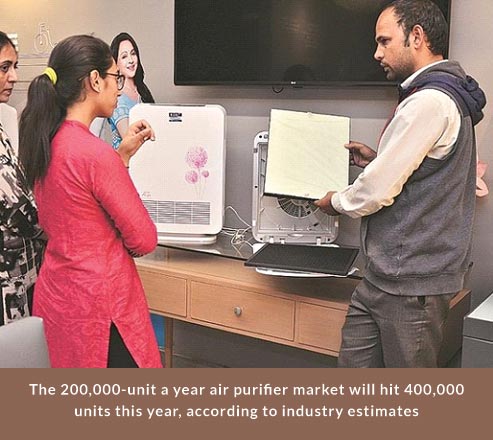

The market for air purifiers is confined to northern India, which contributes close to 80% of the annual sales of Rs 500 crore

Arnab Dutta | New Delhi Last Updated at November 9, 2017 01:28 IST | Source: Business Standard

off the shelves. But sales have skyrocketed since yesterday.”

Air purifiers, masks and respirators have been flying off the shelves since the capital region has come under a thick layer of smog.

Since Monday, sale of air purifiers has doubled. When air quality worsened on Tuesday, marketers saw a 250 per cent jump in sales.

The market for air purifiers is confined to northern India, which contributes close to 80 per cent of the annual sales of Rs 500 crore. For the past few years, the market has been growing by more than 50 per cent. However, growing awareness among consumers — thanks to promotional activities by all major marketers — got more consumers into retail outlets this time. According to industry estimates, the 200,000 units a year market will hit 400,000 units this year. “We have sold some 7,000 pieces in November, which is 250 per cent higher than the sales in the same period last year,” said Kishalay Ray, president, consumer electronics division, Sharp Business Systems. “During October, too, year-on-year sale was better as we saw 2,800 units fly

Home Fashion magazine had a detailed talk with Mr. Mohit Modi, Managing Director, Spread Home Products Pvt. Ltd., who is a pioneer in genuine imports, marketing and distribution of well-known international brands of home textiles and home decor in India now for over 15 years. Purpose was to assess whether demonetisation of Rs. 500 and 1,000 notes by Government of India will have a cascading effect on imports of home textiles and home decorproducts in general and on his own business in particular.

Will demonetisation be a game changer in Indian imports? We asked Mohit Modi,

“Irrespective of demonetisation, in India, you must bring a structural change in your business every 2-3 years if you have to survive. This is because it is dynamic economy and a rapidly evolving market, where consumer profile and preferences as well as competitive scenario keep changing. Besides, the Government policies to keep changing, which can impact business positively or adversely from time to time.

Demonetisation effect

Spread Home itself experienced significant impact. For first three days after 8th November, there was absolutely no business. Then the situation started settling down. Still, hard goods sales dropped by 70-80% whereas home textiles lost 25% of the normal sales.

Some stores preponed their end of season sale to second week November which generally starts in January or end December. This brought little improvement in sales, but only in case of Large Format Stores (LFS). Stand alone furnishing stores are very badly hit and some of them are still in that zone. They had already lost bed & bath products sales significantly to LFS on account of superior visual merchandising and services as well as to online retailers. Online sales are up, as people buying online were already using plastic money. Young, modern consumers in any case never carried cash. Many offline buyers went online for shopping to avoid additional cash spending beyond shopping, on going out. LFS are likely to return to normal sales figures by January end.

Impact on Import business

“90% of the importers in our business used to survive on undervaluation and havala payments. This havala or illegal transfer of money has completely stopped now because exchange rate of a dollar in grey market went up by 30-40%, making illegal transfer meaningless. Therefore, an importer might as well pay import duty on full value instead of making payment through havala and get on wrong side of the law,” says Mohit Modi. But through legal route, such importers, who were purely surviving on low prices with no product concept, market understanding or brand value, are finding it difficult to compete. Products become expensive when they have to pay proper import duty and VAT. Such unscrupulous importers have been doing that business for 20-30 years and will now find it difficult to switch over to a fair, legal business. We have already seen some exits. It is common knowledge that Karol Baugh did a mind blowing business with old currency for afew days. And nowthey arefacing bigproblem.

“A quilt worth Rs. 5000, for which we could not sell more than 200 pieces in the entire year, has clocked a sale of 1,000 pcs. in last 15 days post demonetisation!” says Mohit Modi. This is the miracle of demonetisation, making fair players like Spread competitive in the market. Importers who were selling similar quilt for Rs. 3000 were forced to increase their prices to realistic levels. In such given situation a consumer would anytime prefer buying abrand over unbranded products.

“So we have benefitted from demonetisation!” says Modi.

More importers emerging?

If the business of import is likely to become fair, will more entrepreneurs enter the fray? “No not at all,” says Mohit Modi and explains, “India’s major import scenario and the whole system were based on undervaluation. Cost calculation was done on a different level all together. Business can be done once you have good network, good sales policy and invest in infrastructure. If you do that, you have to strive hard tosurvive, compete and stay inbusiness profitably, like any other competitive business. So the incentive of making quick and easy money doesn’t exist any more!” Then how does Mohit Modi see Indian import scenario evolving? Like he said, he doesn’t see many new organized importers entering the field, except those with along term commitment. So can we say that Indian market will now open t0 established international brands and supplies wish to do genuine business? Who wish t0 develop India as a market? With home products consumption growing between 20-30%, this wlll certainly happen. India offers great opportunity to brands across the globe.

Spread Home itself has to come up with a new business strategy every 2 years to keep pace with these changes. Consumers in a high growth economy like India wish to experience new shopping avenues frequently. With growing cities, people are getting exposed to fashion and newer lifestyle trends. People aspire to bring a change in their lifestyle unlike European countries where Spread Home itself has to come up with a new business strategy every 2 years to keep pace with these changes. Consumers in a high growth economy like India wish to experience new shopping avenues frequently. With growing cities, people are getting exposed to fashion and newer lifestyle trends. People aspire to bring a change in their lifestyle unlike European countries where people are saturated with experiences and are now living the best of lifestyles.

China adapts to these changes faster than India. This is because India is a multi-cultural society while China is a uni-cultural society, where acceptance of change gets adapted faster. China as economy is more stable. India has witnessed many factors during the last 6-8 months. For example demonetisation which stalled business activity in India, has impacted imports and also adversely affected retail sales. This impacted the entire backward chain.

But in today’s global market environment which is highly driven by technology, cost and frequent change of fashion and lifestyle, where does the future of handmade carpet industry stand? The industry is here to stay and prosper, if we are to conclude from India’s own export statistics and the vision the industry holds for itself as a dominant global market player.

On Spread Home

Spread has been growing at 25% year on year. Inthecurrent FY, the growth has been 20% sofar.

Spread is present in about 400 stores (including all Shoppers Stop) across the country in around 100 locations. In addition, about 350 MBOs stock Spread products. Per stores sales on an average are growing by about 25% per annum. Overall, thegrowth is good.

“Import content, has come down from 100% to 85% for Spread product range. This has reduced a little further as the brand has started sourcing some more products domestically. But our experience with domestic sourcing has not been very pleasant in terms of quality and consistency and we may have to go back to imports. Today, the markets are very competitive and import seems inevitable, as our brand image has to be protected. In any case, prices are very competitive even in import. Share of textiles in our business is still 90%. Hard goods business is very promising, interesting and creative business but has to grow further. Mr. Modi is trying to find more spacefor these products in stores across India. We are able to reduce competition in b import by constantly moving into more and more speciality fabrics and products that are more premium, more luxury. Those who are focussing on mass market and cheaper products are finding the competition tough. New players in import have to either enter the market in aclean way or will find the going and competition tough in India.

Demonetisation effect

Spread Home itself experienced significant impact. For first three days after 8th November, there was absolutely no business. Then the situation started settling down. Still, hard goods sales dropped by 70-80% whereas home textiles lost 25% of the normal sales.

Some stores preponed their end of season sale to second week November which generally starts in January or end December. This brought little improvement in sales, but only in case of Large Format Stores (LFS). Stand alone furnishing stores are very badly hit and some of them are still in that zone. They had already lost bed & bath products sales significantly to LFS on account of superior visual merchandising and services as well as to online retailers. Online sales are up, as people buying online were already using plastic money. Young, modern consumers in any case never carried cash. Many offline buyers went online for shopping to avoid additional cash spending beyond shopping, on going out. LFS are likely to return to normal sales figures by January end.

Impact on Import business

Impact on Import business “90% of the importers in our business used to survive on undervaluation and havala payments. This havala or illegal transfer of money has completely stopped now because exchange rate of a dollar in grey market went up by 30-40%, making illegal transfer meaningless. Therefore, an importer might as well pay import duty on full value instead of making payment through havala and get on wrong side of the law,” says Mohit Modi. But through legal route, such importers, who were purely surviving on low prices with no product concept, market understanding or brand value, are finding it difficult to compete. Products become expensive when they have to pay proper import duty and VAT. Such unscrupulous importers have been doing that business for 20-30 years and will now find it difficult to switch over to a fair, legal business. We have already seen some exits. It is common knowledge that Karol Baugh did a mind blowing business with old currency for a few days. And now they are facing big problem.

“A quilt worth Rs. 5000, for which we could not sell more than 200 pieces in the entire year, has clocked a sale of 1,000 pcs. in last 15 days post demonetisation!” says Mohit Modi. This is the miracle of demonetisation, making fair players like Spread competitive in the market. Importers who were selling similar quilt for Rs. 3000 were forced to increase their prices to realistic levels. In such given situation a consumer would anytime prefer buying a brand over unbranded products.

“So we have benefitted from demonetisation!” says Modi.

More importers emerging?

If the business of import is likely to become fair, will more entrepreneurs enter the fray? “No not at all,” says Mohit Modi and explains, “India’s major import scenario and the whole system were based on undervaluation. Cost calculation was done on a different level all together. Business can be done once you have good network, good sales policy and invest in infrastructure. If you do that, you have to strive hard to survive, compete and stay in business profitably, like any other competitive business. So the incentive of making quick and easy money doesn’t exist any more!”

Then how does Mohit Modi see Indian import scenario evolving? Like he said, he doesn’t see many new organized importers entering the field, except those with a long term commitment. So can we say that Indian market will now open to established international brands and supplies wish to do genuine business? Who wish to develop India as a market? With home products consumption growing between 20-30%, this will certainly happen. India offers great opportunity to brands across the globe.

International players will now have options of working on three possible business models in India. One, to continue working with clandestine buyers with unstable future, second to work with professional importers like Spread Home and develop long term business with branding, distribution and retail support. Third option is to enter the market directly on their own by setting up their own marketing, distribution and warehousing set up, which will be a very very expensive proposition at the current volumes this country offers.

Opportunity to consolidate

Across home category, there are very few brands in Indian market who present organised collections three times a year. For Indian brands it is a good opportunity over the next few months to consolidate their position as they will face less competition from cheap imports. Indian brands need to also learn to be more lean and competitive in terms of cost control and prices. At the same time, they need to promote their brands aggressive amongst retailers and consumers. If they succeed in doing so at this point, they will be a big winner. They must be able to deliver right product, at the right price and at the right time. Their answer cannot be in import.

Retailers on the other hand need to change or recycle their merchandise every two months. Most of them need small volumes, specially with this condition of frequent merchandise change. Hence, not many Indian retailers are in a position to import directly as they cannot meet the MOQs.

India’s consumer spending on luxury goods may take a beating as a fall out of demonetisation. The real super luxury buyers of India never shopped here and hence demonetisation has not affected that end of the market. It is the entry level luxury buyers and unscrupulous earners, politicians and bureaucrats, tax evading businessmen who will move from the market for now. I expect a lot of turbulence in the market until the Diwali of 2017.

Our recent interactions with home industry players with focus on Indian market and exporters catering to rest of the world have been quite revealing. While most international players sounded confident and bullish about the future, domestic players expressed concern about sluggish and subdued Indian market conditions.This seems littlestrange considering that while the world markets are facing crisis like Brexit, India has been showing all signs of gaining strength on the world stage- economic and strategic.

In my opinion, in a market with India’s profile,recessionary trends cannot be long lasting like in the Western developed countries. This is because the Indian economy is fundamentally robust with a healthy GDP growth of over 7.5% alongside a huge and young population with high propensity to spend and make new homes. It has a huge, upwardly mobile and aspirational consumer base, which will provide dream run to any marketer for the next two decades,irrespective of small pockets of short term hiccups due to transitional changes in the country’s policy frame work to make India a more diversified economy.

Over the last two years, high pressure by the Indian Government to go after black money and hoarders on one hand and to regulate the housing & construction sectors in India on the other, have certainly caused turmoil in the Indian housing pushing down demand and prices in the short run. This obviously affected the demand for home textiles, home décor and houseware products adversely as the market here still largely depends on new homes. But, these moves in my opinion are blessings in disguise as the regulatory systems for housing sector and healthier tax systems are likely to bring more stable and long term, sustainable demand by the actual consumers.

Already, after six months of subdued activity on the retail, beginning with the last Diwali season in October 2015, the buying of home products by Indian consumers at retail level seems to be picking up once again since April this year. This of course is a good news for the home textiles,furnishing and home decor industry, which has been reeling under the pressure of lack of demand during this period.

The current buoyancy is likely to only become stronger with the forecast of a good monsoon,which has already started proving right in different parts of India. While we must continue to make all efforts to become members of NSG and global missile clubs, which will certainly help, fact remains, that a good or poor monsoon still continues to affect our economy in the short run directly. Hence, going by current good rains, which is likely to be followed by a good agricultural output, we are going to see 2016-17 as a healthy year for business.

Interestingly, even during the last six months,most brands and retailers with innovative products and business ideas have reported healthy growth in their sales. This is a trend which will become stronger and stronger in India as consumers here are far more discerning than any other emerging economies.

By G D Singh

With rapidly increasing disposable incomes in hand, high aspiration of young Indians to improve their lifestyle, much greater international exposure through travel and media and a huge population of 1.28 billion people, India is today a global marketers’ dream destination, ready to consume a variety of international products. Home textiles, furnishings and home décor categories are no exception.

How are imports impacting the Indian market across product categories like bed & bath linen, furnishing fabrics, floor coverings, rugs and carpets, table & kitchen linen and other home textile products? What are the key benefits of imports? What is driving import in these categories? What are the current import trends? Which are key

import sources for India & why? What is Indian importers opinion on the current and emerging import scenario and future of imports in India in these categories?

Contribution of home textiles in the country’s total exports during Apr-Jan 2014-15 grew by 2.4% as against 2.2% during this period in the preceding year. Contribution of home textiles in India’s overall imports during these periods however remained stagnant at 0.4%. But since India’s overall imports grew by over 30%, even with the same share, home textile imports have grown by 30%.

Why import?

In this era of globalised commerce and consumers across the world seeking international lifestyle, at least partially, some degree of import of finished products in every consumer product category is inevitable, especially in the gigantic, upwardly mobile and highly aspirational market of India’s size. Home textiles, furnishing fabrics and home décor are no exception.

Import content in the overall product mix of Indian market players varies from company to company. It also depends on whether the importer is a brand, wholesaler, distributor, retailer, or these days, even a manufacturer. Spread, a leading premium brand in bed & bath linen segment in India, has an import content of as high as 95%. Mohit Modi, Managing Director, Spread Home feels that innovations, colour co-ordination, design aesthetics and functional aspects are not as well developed in Indian products, as in their European counterparts. “Few good Indian manufacturers like Micro Cotton, who make highly innovative, world-class products, are not willing to offer their best in range products in the Indian market freely. So, we import such items from Italy, Turkey, Korea, and Portugal.”

Obsession, today a well-known brand across India for modern floor coverings, rugs and bath accessories has its genesis in import. Beginning with small consignments of half a container which accommodates about five to ten thousand pieces of bath mats depending on their size and thickness, today Envogue Furnishings, which owns this brand, imports up to 50,000 pieces per article. This makes them one of the largest customers for suppliers in Europe as well as Asia, commanding high respect, good prices and prompt service. “Internationally, we get much better service, more innovative products with quicker deliveries and even better prices,” reveals Ashish Dhingra, Managing Director, Envogue Furnishings. Obsession imports ready to use finished products only, which can be sent through the retail and distribution channels immediately on arrival.

“We thought of imports to meet the growing latent demand for good, easy to maintain, synthetic and machine made products. During 1990s, India mainly produced basic, handmade cotton floor coverings or pure wool rugs and durries,” recalls Ashish Dhingra. “USP of my products was designs, as this is what attracts the customer first; consideration of price as such was secondary. What holds utmost importance to us is the appeal of a product to our customers. Price is the last thing on our mind,” he adds.

“Considering the growing consumption of home textile products in India, supply is less than demand,” feels BS Bagga, Director, Dream Touch. Describing the lacklustre attitude of Indian producers, who according to him are often unable to meet the market expectations, Bagga adds, “Indian manufacturers are happy if they are able to sell whatever they produce! They take no extra effort to innovate on designs or product features. This lack of enthusiasm could also be due to insufficient competition or lack of government support on R & D.”

Two key cost factors which enable one choose between importing and sourcing locally are cost of freight and customs duties. Usually, in today’s times, the difference in international freight and domestic inland transportation costs is negligible. “Even after paying import duties,we find that landed cost of imported products work out better than the prices offered by domestic manufacturers. Besides, additional advantage is that imported products are well-differentiated from those available locally. So even if they work out slightly more expensive, their superior quality and exclusivity give the sellers an edge in the market. Consumers too will be willing to pay more, depending on their affordability,” explains BS Bagga.

Bagga however agrees that there are few large manufacturers in India too, whose products are comparable with their counterparts in China. They are able to offer the same scale, speed and consistency. This is the reason he feels that Indian products are gaining increasing share of key markets like USA. “But fact still remains that as against China’s share of 40% India still controls only 16% of the American market. Hence, India is big, but not much when compared, “Bagga insists.

India also has global Editors in home textiles, in the likes of Rohit Khemka, Managing Director of RR Décor, who sources hi-end products from abroad and export them back to developed countries under own branding. Hailing from a family engaged in handwoven silk trade in Bhagalpur of Bihar province, he always had a penchant for designing his own collections. In 2007 he started import of home textile products and in 2010 he got into the role of Editor.

Earlier 60% of RR Decor collections were sourced from domestic market and 40% from overseas companies. They have designers in Italy, UK and France, besides an in-house team. “There is no in-house production – we choose the fabric and design and get it manufactured from 27 top mills from across the world. The products are done on premium fabrics that cost between Rs.1500 to Rs.10000 per metre,” explains Khemka and adds, “We sell to countries like US, Hong Kong, Saudi Arabia, Turkey, GCC, Oman, UAE, Iran, Brunei, Singapore, Vietnam, Mauritius and China, in the order. There is also institutional sales to hospitality sector clients and interior designers.Distribution in the domestic market is done through speciality retailers like Jagdish Stores, Seasons Furnishings and Bharat Furnishings.”

Key products imported

Rugs & carpets

Total value of rugs &carpets imported during the 10-month period of April-Jan 2014-15 was Rs.434.32 crore.Tufted carpets are popular import variety for India, with a share of Rs.336.15 crore. China, followed by Thailand, USA, UAE, Belgium and Netherlands are major suppliers respectively. Woven (not tufted)Kelem, Schumacks and Karamanieare the next popular range of floor coverings imported during this period with a value of Rs.53.77 crore. Turkey is the top supplier for this, followed by Indonesia, China, Thailand, Belgium and Ireland.

Special woven fabrics

This category according to trade definitions includes Tufted Textile Fabrics; Laces; Tapestries; Trimmings; Embroidery, Quilted Textile Products, assembled with Padding. Imports in this segment during Apr-Jan 2014-15 amounted to Rs.951.12 crore. China was the largest supplier, with over 33% share followed by Hong Kong, Sri Lanka, Vietnam, Germany, Thailand, Korea RP and Taiwan.

Made-up textile articles

The category “Other made-up textile articles”, according to Government definition includes data of Sets; Worn Clothing and Worn Textile Articles; Rags, Blankets and Travelling Rugs, Bed Linen, Table Linen, Toilet Linen and Kitchen Linen, Curtains (including Drapes) and Interior Blinds; Curtain or Bed Valances, Other Furnishing Articles, Other Made Up Articles. Sooner this confusion is cleared, better would it be for the trade and monitoring and import scenario in India.

Since this category includes such a wide range of made-up products, which include largest selling home textile products in India like bed linen, curtains, furnishing and blinds, import value during Apr-Jan. 2014-15 amounted to Rs.549.7 crore. Here too, China was the top sourcing destination followed by Vietnam.

Blankets and travelling rugs were single largest item in this category making up for 75% of the imports with a value of Rs.439.2 crore. China was the dominant supplier. Import of all other made-up articles listed in the category amounted to only Rs.177.5 crore, once again China being strongest sourcing base followed by Bangladesh, UAE, EU and USA.

Preferred import sources

Indian importers buy from different countries for different reasons. “We go to China when we want to source at least a container,” says Ashish Dhingra. Since custom duties are the same on imports from all countries, the only consideration is freight charges. Besides, the degree of service also matters in today’s fast moving markets. “At about 40% additional cost over Ex-factory prices, Chinese suppliers deliver the goods to our warehouse anywhere in India, taking care of all logistics and procedures. This saves us lot of time and effort,” explains Ashish Dhingra.

Obsessions started imports from Belgium, Germany and Turkey and continues to buy from these countries. In addition, today it also imports from China, Indonesia, Malaysia and Taiwan.

Recalling his experiences with approaches of suppliers from different countries in their business dealings, Ashish Dhingra comments, “One should learn flawless quality production from the Europeans, fair trading from Americans and perfect copying from the Chinese.Many European and American companies which had created production facilities in China to achieve cost competitiveness, are now shifting back home or to their nearby countries, where products do not get rampantly copied. So these countries may become our new import destinations”

With rising costs in China and issues of quality, an increase in feeling amongst Indian importers is that importing from China is no more as lucrative as it used to be. Today, China itself imports goods worth US$ 120 billion for their domestic consumption, as against their export of US$130 billion.

China is known as a hub for mass manufacturing for all kinds of products. With intensive push to ‘Make in India’ programme by its Government, India too may soon fall in China’s league. But as of now, Indian companies are not adept to taking up challenges of producing technology and design based products. If both the Government and industry work in tandem, there is no reason, India, which is today the second largest exporter of home textile products in the world, cannot produce world-class products for domestic consumption, like for exports!

Imports not sacrosanct

Not all is well however, with imported products too. “In recent years very little R&D has taken place in textile products in the international market. Global recession can be one of the reasons,” says Mohit Modi, and adds: “Unfortunately India isn’t adapting new technologies as fast as it should. Most Indian manufacturers are too focused on exports even as domestic demand becomes as sophisticated as in any other country. Production cost is same everywhere, you only need to take the lead.”

Home textile products consumption in India is growing 15-20% and so is awareness for Homeproducts.The consumer is ready to spend for a good quality product.

Indian importers are open to sourcing domestically, provided they get product, prices and quality they are looking for. “We source about 5% of our total buying from local producers where they assure us exclusivity of design. But these commitments are sometimes broken.Hence, despite demand for such products being there, we buy only small quantity,” says BS Bagga.

Rohit Khemka says, “Our sales grew 15.5% in FY 2014-15 but could be lower this FY due to subdued markets in the Middle East and Europe. But we will offset the losses by using more of Indian fabrics that will fetch us better margins.”

It is the thought process among manufacturers, importers and retailers that must change. “We can’t think big, and we shy away from competition;yet we want to have maximum profitability,” says BS Bagga. “If there is sudden increase in demand during festivals, we want to increase the price and make more profits rather than scaling up production to gain a larger market share, which will provide more variety to consumers.”

Retaining exclusivity on designs is another factor that necessitates imports. Then there is the issue of adhering to order specifications and timelines.It’s true, very few of the big manufacturers in India are willing to hold stocks or innovate in home textile and home décor products. Those who did are the ones who have grown very fast.

‘Make in India’ impact

WTO guidelines mandate that incentives for export production must go away slowly. Till 10 years back there was 100% income tax exemption on earnings from exports but these got totally removed. Duty drawbacks used to be 10 to 20% earlier but now it is just around 5-6%. Message is clear. All producers must compete on merits in the international markets, and not based on subsidies or cash incentives. There is a hidden message in such policies that Indian manufacturing needs to be globally competitive on merits. By inference, the Indian producers must compete with international products even within the home market. Importers in India too feel the same.

“In India, exporters have made a lot of money through government incentives but it’s all gone down the drain,” says Mohit Modi: “We are a cotton-growing country, much of our superior grade cotton is being exported from India while we import costlier and inferior grade cotton from China and other parts of the world.” These are the fault lines that the Make in India campaign should correct as it will benefit Industry as a whole.

According to Rohit Khemka, “We do not import cheap products, it is all in the premium segment and such products cater to a specific flavour, which has its niche segment of buyers, always. The market for quality home textile products in India is growing 15-20% per year while the market for locally available products is growing at 10-15%. So there is always room for imported premium quality products.”

It is generally accepted that India’s home textiles and home décor market will grow by 20% annually for next 10 years. Policy changes will only make entry of unbranded products tougher. There will be more imports of branded items even as some of those brands will want to set up production facilities in India. With growth, domestic demand for a wide variety of home products will increase. If this demand is not being supplied by domestic manufacturers, imports are inevitable – if blocked, it will lead to monopolistic cartelisation, and Indian consumers will be the ultimate losers. So imports will always remain a necessity for healthy competition and consumption growth.

Clothes alone do not follow seasonal trends, as may be popularly believed in India. In today’s markets, home décor and furnishing sectors too have to perennially remain in vogue, by closely following changing consumer lifestyle and preferences on an ongoing basis. Just like what is inside the consumers’ wardrobe changes seasonally, so does the look of their homes. After all, following the global trends, decorating smarter is the new mantra for contemporary consumers in India.

It is said that furniture should be designed to last. However, frequent updates with new look accessories can bring a distinct change to the look and feel of the space housing such furniture with little investment in time and money. Classic big-ticket furniture pieces when combined with a bolder genre of furnishings, upholstery and

accessories, make up the new ethos of contemporary home design.

Shagufta Anurag, the co-founder at Livspace, a premium end-to-end home design service group who are also in to experiential e-commerce, is of the view that that bespoke services and personalisation in the home segment is a notable macro trend. The width of choice in home accessories and henceforth the possible permutations and combinations allow every individual to have a home as unique as themselves.

The Livspace team derives its ideas and inspirations on international design aesthetic through frequent interactions with designers from the world over (especially Milan) and also with exceptional homegrown talent. Tommasso Bistachchi, the Design Lead, says the major trends this season are as diverse as ethnic inspirations from the East to the bold colours and geometric patterns derived from an electric mood. Whether an individual’s preference is eclectic and bold or refined and subtle, the multifarious trends allow your home to be both – an extension of yourself and at par with the latest trends.

You can update your curtains, blinds, rugs, throw cushions or simply add upholstered wall panels to transform your room. The major colours can be branched into two distinct groups. When it comes to bold colours, mediterranean blue, teal, turquoise, forest green, sunshine yellow, deep lavender and lime green rule the roost. In contrast the subtle palette consists of sunset-inspired hues, pastels and greys.

For the prints, ethnic inspired motifs, ikats and geometrics from stripes to triangles take the front seat. Oak and mahogany furniture, with clean lines or classical undertones, form the perfect backdrop for this new love for accessories. Same goes for neutral rooms, as they can be enlivened instantly by updating furnishings and accessories.

Government of India’s “Housing for all by 2022” scheme is likely to see construction of over 30 million new homes over the next 8 years and will certainly provide a major boost to demand for home textiles, furnishing, home décor and houseware products, which even currently is growing at a healthy 25% annually. These trends were uniformly confirmed by leading retailers, brands, manufacturers and importers alike during talks at HGH India 2014.

In terms of purchasing power parity (PPP) based GDP, India is already the world’s 3rd largest economy next only to USA and China. In absolute GDP terms too, the country is likely to be amongst top three global economies by 2030. With an annual GDP growth between 6-8% on a population of over one billion people, India will remain one of the fastest growing global markets for all products over the next 15-20 years, including for home products. That is why major international manufacturers and brands as well as leading Indian exporters are taking keen interest in locating the right business partners, agents, distributors, importers, retailers and representatives in this market.

Upwardly mobile young Indian consumers below the age of 30 years, who constitute 65% of country’s total population, are showing increased preference for high quality and branded international products for their day to day needs. With their high exposure on internet, frequent travel and highly interactive professional life, they swiftly adapt to international lifestyle trends. Brands and manufacturers need to quickly associate with the right retail channels who are connected to these young consumers. HGH India facilitates this very effectively.

Unique dynamics of the Indian market

- With 1.28 billion people in 2015 representing one-sixth of the world’s population

- GDP growth to remain highest in the world, between 7% to 10% p.a over next 5 years

- Large working population and families with multiple earning members

- Young population – 65% of below 30 years of age

- Increasing spends on lifestyle, décor and home improvement products

- By 2020 average age of an Indian will be 29 yrs; compared to 37 for China

Indian Market Overview

- Indian retail is projected to grow from US$550 billion in 2015 to US$2.1 trillion by 2025, almost 4-fold increase

- Modern Retail to grow at a CAGR of 22%, from US$40 billion to US$320 billion in next 10 years

- E-commerce likely to grow 26 times, from US$5 billion in 2015 to US$130 billion by 2025

- Indian Home Décor and Houseware markets are growing at a steady 25-30% p.a.

- India’s domestic home textiles and home furnishings market is growing by 40% p.a and is projected to be in excess of US$13 billion by 2025.

Indian Home Market: Changing Scenario

Hardly a decade back purchase of home products in India would happen only during major festivals. These products would include home textiles like bed linen, towels & cushion covers, furnishing fabrics for curtains & upholstery, houseware products like tableware, kitchenware, glassware and home decoration & Gifting items like artefacts, decorative lamps, candle stands, blinds, wall papers, vases, flowers & fragrances and so on. Things have changed drastically now. The phenomenal growth in Indian retailing, increase in purchasing power of Indian people and growing consumerism continues to transform the lifestyle of Indian middle class, year on year.

Home Fashion is now appears to be treading a similar path as Fashion Apparel. Young Indian consumers now seek home products that are trendy, unique and are appropriate to the occasion and season. There is a growing demand for high quality, stylish and well-coordinated home products and the working young couples of urban India – from metropolitan cities down to the Tier-III towns – take pride in imparting a bit of their own personality to the look of their homes. They don’t mind visiting several shops and shopping centres to pick up the right mix of home textile, home décor and houseware products which synergize with each other in terms of colours, designs, materials and overall look and feel. These enthusiastic consumers enjoy regular shopping at department stores, hyper markets, speciality stores, designer boutiques and they are also the major drivers of e-retailing in India. These young Indians with high disposable incomes are also getting generous with the budget for gift spends.

Prospects extremely bright for Home Products

With a booming services sector, increased IT usage resulting from world-class telecom services, increased travel and information explosion through print, television and online media, Indian consumers now have considerable exposure to global lifestyle ideas and trends – thereby making India one of the most promising new markets for retail expansion.

Home products market growth drivers:

– Increase in disposable income of young consumers

– Proliferation of nuclear families

– Government policy of affordable housing for all by 2022

– Rapid growth of e-commerce & modern retail

The tradeshow designed to connect you with the Indian Market

The tradeshow designed to connect you with the Indian Market